The Mexico Flat Glass Market Size valued at approximately USD 1,090.11 million in 2023, is expected to grow at a steady compound annual growth rate (CAGR) of 4.2% during the forecast period of 2024-2032, reaching a projected value of nearly USD 1,460.35 million by 2032. The market’s expansion is fueled by various factors, such as increasing demand from the automotive, construction, and energy sectors, along with technological advancements in glass production. This article delves into the key drivers, challenges, opportunities, and trends within the Mexico flat glass market, offering a comprehensive analysis of its growth trajectory and future prospects.

Key Benefits of the Mexico Flat Glass Market

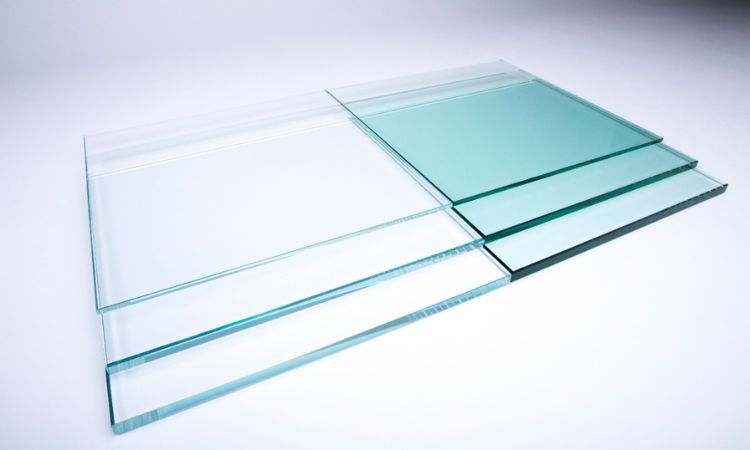

- Versatility: Flat glass is used across multiple industries, such as automotive, construction, solar energy, and electronics, providing a broad market base.

- Energy Efficiency: Flat glass products, such as energy-efficient windows and solar panels, contribute significantly to sustainability efforts, reducing energy consumption in buildings and vehicles.

- Technological Advancements: With innovations in glass coating, self-cleaning technologies, and energy-efficient solutions, flat glass products are becoming increasingly versatile, high-performing, and aesthetically appealing.

- Safety and Durability: The rising demand for tempered and laminated glass, particularly in the automotive and construction industries, enhances the market’s appeal due to its safety features and durability.

- Economic Development: Mexico’s growing construction and automotive sectors provide a stable base for the flat glass market, further driving its demand.

Key Industry Developments

Several notable developments are shaping the Mexico flat glass market:

- Technological Innovations: Companies in Mexico have been at the forefront of adopting cutting-edge technologies, such as the production of low-emissivity (Low-E) glass, which offers excellent thermal insulation and reduced energy costs. Innovations in the automotive glass segment, including the production of heat-resistant and UV-blocking glass, are also contributing to market growth.

- Increased Investments: Mexico’s strategic location and its proximity to the United States have attracted global investments in the flat glass sector. Foreign manufacturers are expanding their operations in Mexico to cater to the rising demand in North America.

- Sustainability Initiatives: The increasing focus on sustainable building materials is driving the adoption of energy-efficient and eco-friendly glass products. The Mexican government’s push for energy efficiency in construction and residential buildings has positively impacted the market.

- Automotive Growth: The flat glass market is seeing strong growth in the automotive sector, with rising demand for advanced glass solutions such as lightweight glass and glass that enhances vehicle fuel efficiency.

Driving Factors

Several key factors are contributing to the growth of the Mexico flat glass market:

- Rising Demand from the Construction Industry: The booming real estate sector, particularly in residential and commercial properties, is one of the main drivers for flat glass products. As construction projects require glass for windows, doors, and facades, this demand is expected to continue to rise.

- Growth of the Automotive Sector: Mexico is one of the largest automotive manufacturers globally, and the demand for automotive glass continues to rise. With the growing adoption of advanced glass technologies such as laminated glass and privacy glass, the automotive sector remains a key contributor to market growth.

- Technological Advancements in Solar Glass: The increasing adoption of solar energy solutions is also driving demand for solar glass, a segment that is gaining prominence in Mexico due to the country’s commitment to renewable energy sources.

- Government Initiatives for Energy Efficiency: Mexican policies that promote green buildings and energy-efficient solutions in construction are bolstering the demand for flat glass products, particularly energy-efficient windows.

- Urbanization: With an increasing urban population and rapid infrastructure development, the demand for construction materials, including flat glass, is expected to rise, contributing significantly to the market’s growth.

Restraining Factors

Despite the positive outlook, the Mexico flat glass market faces some challenges:

- High Manufacturing Costs: The production of flat glass requires significant energy consumption and the use of raw materials, such as silica, soda ash, and limestone. These factors contribute to high manufacturing costs, which could limit the growth potential of the market.

- Environmental Impact: Although glass is 100% recyclable, the production process still generates carbon emissions and consumes large amounts of energy. Increasing pressure on manufacturers to reduce the environmental footprint could pose a challenge.

- Competition from Alternative Materials: The availability of alternative building materials such as acrylics, plastics, and composite materials presents competition for the flat glass market, particularly in low-cost applications.

- Supply Chain Disruptions: Supply chain disruptions, particularly in sourcing raw materials like silica sand, could impact the smooth functioning of the flat glass manufacturing process, potentially delaying production and increasing costs.

Market Segmentation

The Mexico flat glass market can be segmented based on application, type, and end-use industry:

- By Application:

- Automotive Glass: This segment includes glass used in vehicle windshields, side windows, and rear windows. The demand for automotive glass is expected to increase with the rise in vehicle production and sales in Mexico.

- Building Glass: Glass used in residential, commercial, and industrial construction for windows, facades, and skylights is a major contributor to the flat glass market.

- Solar Glass: The growing adoption of solar energy is expected to fuel the demand for solar glass, used in the production of photovoltaic solar panels.

- By Type:

- Tempered Glass: Tempered glass is widely used in the automotive and construction industries due to its safety features. It is a strong segment in the market.

- Laminated Glass: This type of glass is commonly used in automotive windshields and building facades, offering better safety and sound insulation properties.

- Low-Emissivity (Low-E) Glass: With a focus on energy efficiency, Low-E glass is gaining traction, particularly in construction and automotive sectors.

- By End-Use Industry:

- Construction: With the expansion of the real estate sector, the construction industry remains a significant contributor to the demand for flat glass.

- Automotive: As one of the largest automotive manufacturers, the automotive industry is another major consumer of flat glass products in Mexico.

- Solar Power: The shift toward renewable energy sources has led to increased demand for flat glass in the production of solar panels.

Market Outlook

The Mexico flat glass market is expected to experience steady growth in the coming years, driven by increasing demand in the construction, automotive, and renewable energy sectors. As urbanization accelerates and technological advancements continue, new opportunities will emerge, particularly in sustainable building solutions and energy-efficient glass products.

The growing automotive industry and the expansion of the solar energy sector present significant opportunities for market players. The flat glass market will continue to evolve with a focus on sustainability, innovation, and energy efficiency.

Trends in the Mexico Flat Glass Market

- Sustainability: A major trend in the industry is the increasing demand for sustainable and energy-efficient flat glass products, which aligns with global trends toward reducing environmental footprints.

- Smart Glass: The rise of smart glass solutions that allow for energy-saving properties, such as adjustable tinting or smart windows, is creating new opportunities in both the automotive and construction sectors.

- Green Building Regulations: Mexican regulations supporting energy-efficient buildings are driving the adoption of advanced glazing technologies that provide insulation, solar heat gain, and improved energy efficiency.

Regional Analysis

Mexico is well-positioned as a key market within North America, especially due to its proximity to the U.S. and the growing importance of the manufacturing sector. The flat glass market is expected to experience robust demand across key cities, particularly in areas such as Mexico City, Monterrey, and Guadalajara, where construction activity is high.

Major Key Players

- Vitro, S.A.B de C.V

- Saint Gobain S.A.

- Guardian Glass LLC

- AGC Inc.

- Nippon Sheet Glass Company Ltd.

- Others

Opportunities

- Growing Demand in Renewable Energy: The shift toward sustainable energy solutions, such as solar energy, creates significant demand for solar glass.

- Technological Advancements: Opportunities exist in the development of smart glass, low-emissivity coatings, and advanced automotive glass technologies.

- Infrastructure Development: Mexico’s ongoing infrastructure development projects will continue to boost the demand for flat glass in commercial and residential buildings.

Challenges

- Raw Material Supply Chain Issues: Global supply chain disruptions, particularly for raw materials, can lead to price volatility and delays in production.

- Economic Fluctuations: Economic instability can affect the demand for flat glass, especially in the construction and automotive sectors.